The current lending process is afflicted with less transparency and less visibility into the end-to-end process for a user. Traditional lending processes also involve third-party organizations that take more time and higher fees. The entire process would also take days, sometimes weeks to be processed.

DeCredit - Decentralized Credit Platform with DAML

Partner: Knoldus

Technologies Used: DAML, Blockchain

Domain: Blockchain

The Challenge

Knoldus wanted to build a direct lending platform that would solve these challenges and make the lending process more efficient. What we had in mind was reduced cost by removing the need for intermediaries, quick resolution of the lending process, and providing flexibility in interest rates.

Our Solution

Our solution came in the form of a direct lending platform where legal agreements can be established, repayment can be completed, and relevant changes can be updated to a shared ledger in real-time while maintaining confidentiality as needed.

DeCredit is a DAML-powered decentralized loan lending application backed by digital collaterals in a peer-to-peer network. The borrower in need of money can create a profile on the platform and initiate a loan request by setting one of their digital cryptocurrencies as a collateral. DeCredit also supports other types of collaterals that reside offline. The lenders can check the existing loan requests, and based on the risk assessment, propose the amount and a desired rate of interest. The borrower can then choose from among the various proposals received and select the one that suits their needs.

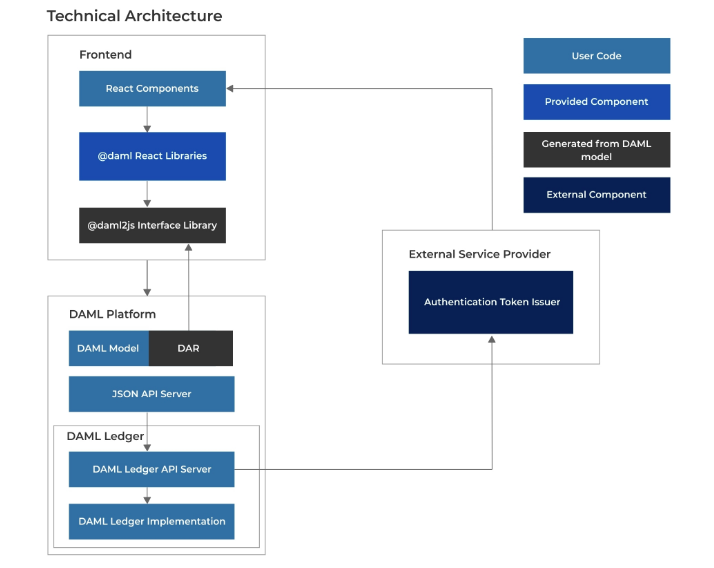

Technical Architecture

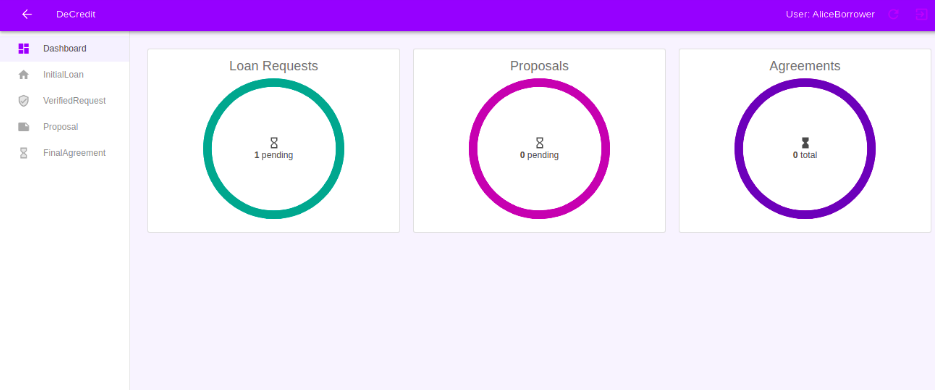

Here is a quick view of the Borrower Dashboard:

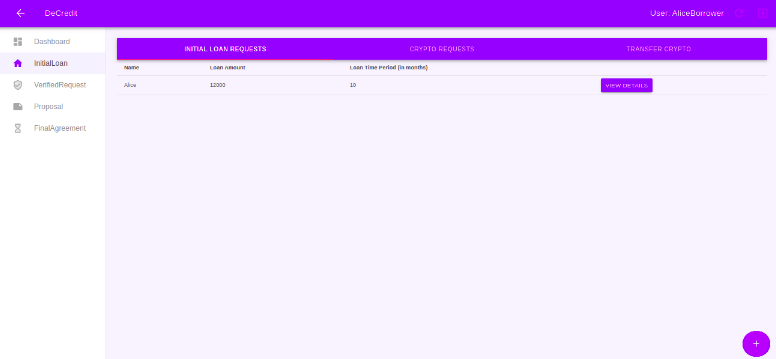

Borrower Loan Requests:

Benefits

Direct lending between borrowers and lenders.

Real-Time loan transactions.

Use of cryptocurrency as a collateral.

End to end flow transparency.

Easier regulatory reporting and compliance.

Get In Touch:

Looking for similar or other solutions for the financial industry? Get in touch or send us an email at hello@knoldus.com. We are a proven, experienced Certified Lightbend Partner, available for partnering to make your product a reality.

Relevant Resources

CASE STUDY

Creating automation bots using Python and DAZL library to automate creation, archival, or exercise of choices in DAML Smart Contracts